This guide breaks down how to set up a Lasting Power of Attorney (LPA) for Property and Financial Affairs, including choosing an attorney, filling out and registering the form, and understanding legal essentials to ensure it's valid and effective.

This article is your roadmap to understanding and creating a Lasting Power of Attorney for Property and Financial Affairs, so that you can confidently secure your financial future.

What is a Lasting Power for Property and Financial Affairs?

In the UK, creating a Lasting Power of Attorney (LPA) for property and financial affairs is common, especially among older individuals and those planning for future incapacity. Historically, property and financial LPAs have been more popular than health and welfare LPAs, with around 93% of LPA filings focusing on property and financial decisions.

This preference is largely due to the practical benefits, as it allows appointed attorneys to manage your:

- finances,

- pay bills,

- handle property transactions, and

- make other essential financial decisions if the donor becomes unable to do so.

LPA for property and financial affairs ensures your financial matters and property are taken care of according to your wishes.

Read more: How to Use a Lasting Power of Attorney?

Do You Need LPA for Only Property and Financial Affairs but Also for Health and Welfare?

You can do both at Aatos. Simply answer to a few questions and the service will generate tailored LPAs for you.

Ready in 10 minutes! Download immediately!

Lasting Power of Attorney for Property and Financial Affairs Offers Peace of Mind

Having an LPA for Property and Financial Affairs offers peace of mind by ensuring your finances and property are managed effectively.

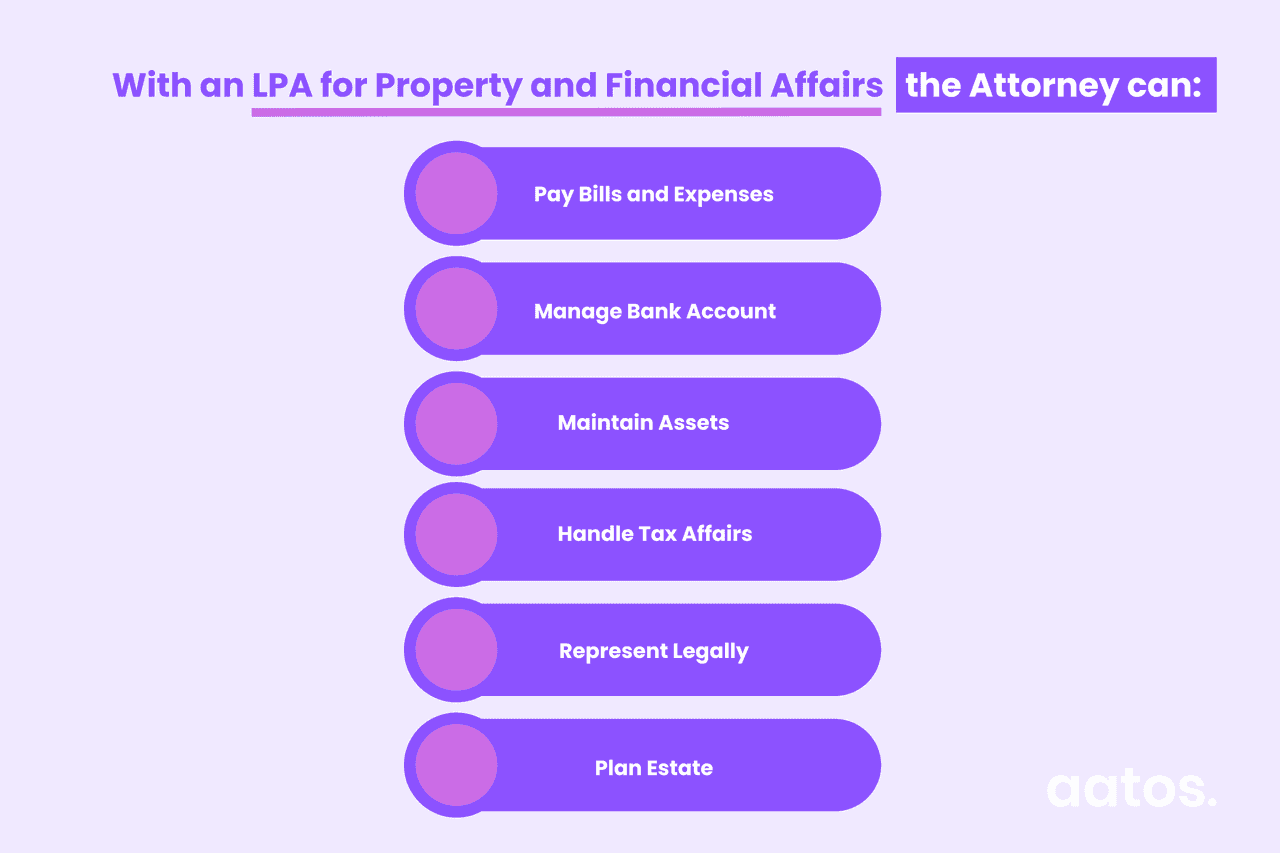

With an LPA for Property and Financial Affairs the Attorney can:

- Manage Bank Accounts: Operating your bank and savings accounts, including withdrawing money, paying bills, and managing investments.

- Pay Bills and Expenses: Handling household expenses, medical costs, insurance premiums, and other regular payments.

- Invest Money: Making or changing investments to help grow your estate or generate income according to the guidelines you've set.

- Buy or Sell Property: Making decisions about purchasing a new property or selling one you own. This can include your primary residence if not restricted.

- Rent and Lease: Managing any rental properties, including collecting rent, handling leases, and interacting with tenants.

- Maintain Assets: Overseeing the maintenance and repair of your properties and other significant assets.

- Handle Tax Affairs: Completing and submitting your tax returns, and managing communications with tax authorities.

- Plan Estate: Implementing or updating your estate planning strategies in line with your financial goals and family needs.

- Represent Legally: Acting on your behalf in legal matters that pertain to your financial and property interests.

The Process of Creating an LPA for Property and Financial Affairs

⚠️ Please note, this guide is specifically designed for navigating the LPA process within the UK legal system.

- Download the LP1F form from the UK government website: You can download it the LP1F from.

- Deciding on an Attorney: Choosing the right attorney for the LPA is one of the most important decisions you can make. Look for someone trustworthy, financially savvy, and who understands your wishes. It could be a family member, a close friend, or a professional advisor. The attorneys must be at least 18 years old and not bankrupt or subject to a Debt Relief Order.

- Completing the LPA Form: Filling out the LPA document can be straightforward but requires attention to detail. Start by gathering all necessary information about your assets. The form will guide you through appointing your attorney(s), specifying what they can and can't do, and how you want them to work together if there is more than one.

- Signing and Witnessing: Once filled in, you and your attorney need to sign the document in the presence of a witness. This witness can be anyone over 18, as long as they aren’t named in the LPA. The document needs to be signed with a pen (not a pencil).

- Certificate Provider: The LPA also needs to be signed by a certificate provider to confirm that no one is forcing you to make the LPA and you understand what you’re doing. This is someone that has known you for over 2 years (such as a friend or colleague) or a professional (such as a doctor or lawyer).

- Pay the fee: After everyone has signed, pay the relevant fee outlined in the LP1F Form (currently £82 per LPA).

- Registering with the Office of the Public Guardian: Post your LPA to the Office of the Public Guardian for registration. Remember, your LPA won't be valid until it's registered.

Read more: What is an LPA Activation Key?

Lasting Power of Attorney for Property and Financial Affairs: Legal Requirements and Considerations

For your LPA for finance to be valid, it must meet certain legal standards:

- Formality: The LPA must be completed using the correct form provided by the Office of the Public Guardian.

- Registration: The LPA must be registered with the Office of the Public Guardian before it can be used. This involves submitting the completed form along with the registration fee.

- Full Disclosure: You need to provide complete and accurate information about your finances.

- Voluntary Agreement: It must be clear that you're setting up the LPA of your own free will, without pressure from anyone. Therefore, it needs to be properly witnessed as well as duly signed by a certificate provider.

- Clear Instructions: If you add specific instructions you want your attorney to follow you need to ensure these are clear.

Ensuring your LPA meets these criteria will make it effective and enforceable, providing solid groundwork for managing your property and financial affairs according to your wishes.

💡 If you want to be sure that your LPA is legally valid but you find the paperwork too complex, Aatos is about to launch a UK LPA service to hold your hand through the entire process. So, keep your eyes peeled for this exciting development!How to Change or Cancel an LPA for Property and Financial Affairs?

In the UK, you can change or cancel a Lasting Power of Attorney (LPA) for property and financial affairs as long as you have the mental capacity to do so.

To make changes, you can either add restrictions or replace an attorney by completing the relevant forms provided by the Office of the Public Guardian (OPG).

To fully cancel your LPA, you must send a written notice called a 'deed of revocation' to the OPG and inform all appointed attorneys about the cancellation. It’s important to ensure that these steps are carried out correctly to make the changes legally binding.

How To Make Changes to LPA?

In the UK, you'll need to follow specific steps outlined by the Office of the Public Guardian to make changes to your LPA.

However, do note that it is not possible to add a new attorney to an existing LPA. This will require a new LPA to be made.

Also, once you've lost mental capacity, you cannot make changes to your LPA. This is because the ability to understand the nature and effect of the LPA, as well as the powers being granted to attorneys, is necessary to make changes.

If your Power of Attorney has come into effect but you do not believe that your attorney is acting in your best interests, you can contact the OPG with your concerns.

Amending an LP1F steps:

- Check the Existing LPA: Review the existing LP1F to see if it allows you to make minor amendments. Some LPAs include clauses that allow for simple changes without revocation. For example, you may need to update a name or address of someone listed in the LPA. To do so, you need to post the updated details to the OPG.

- Do not change the LPA itself as this will invalidate it.

- Complete a New Form if Necessary: If your existing LPA doesn't allow for amendments, or you want to add a different attorney, you will need to complete a new LP1F form with the desired changes. To bring your new LPA into effect, it's essential to register it with the OPG, following the same process as you did for your initial LPA.

⚠️ Important: Creating and registering a new LPA does not automatically revoke the old one. You need to take specific steps to cancel the previous LPA.

How to Cancel Your LPA?

If you've decided that you no longer require or want your existing finance LPA, you can go through the process of revoking it.

Revoking the LPA Steps:

- Complete a Deed of Revocation: Use the following wording for the deed of revocation. Replace the words in the square brackets with the relevant details:

Deed of revocation

This deed of revocation is made by [your name] of [your address].

1: I granted a lasting power of attorney for property and financial affairs/health and welfare (delete as appropriate) on [date you signed the lasting power of attorney] appointing [name of first attorney] of [address of first attorney] and [name of second attorney] of [address of second attorney] to act as my attorney(s).

2: I revoke the lasting power of attorney and the authority granted by it.

Signed and delivered as a deed [your signature]

Date signed [date]

Witnessed by [signature of witness]

Full name of witness [name of witness]

Address of witness [address of witness].

- Notify Relevant Parties: Notify the attorneys named in the original LPA, as well as any other relevant parties, that the LPA is being revoked. You may need to provide them with a copy of the revocation deed.

- Submit the Form to the OPG: Send the completed revocation form to the OPG for registration. There may be a fee associated with revoking the LPA. You should also keep a copy of the revocation deed for your records.

It’s essential to follow these steps carefully to ensure that the revocation of your LPA is legally valid and properly documented. If you're unsure about the process or have any questions, consider seeking advice from a legal professional or contacting the OPG for guidance.

Caring for Your Future with an LPA

Setting up a financial LPA is a proactive step towards securing your financial future.

By carefully completing the LP1F government form, ensuring that it’s been signed correctly and then registered, you ensure that your property and finances are managed according to your wishes, offering peace of mind to both you and your loved ones.