A prenuptial agreement, commonly known as a prenup, is a legal document created by a couple before marriage to outline the division of assets and financial responsibilities in the event of a divorce or separation.

Prenup offers clarity and protection, ensuring both parties understand their rights and obligations. While often associated with wealth, a prenup can benefit couples of all financial backgrounds by addressing property, debts, and future earnings, making it a practical step in modern relationships.

But what is a prenup after all and what does it contain?

In this article you'll find what is a prenup. It will include all the basic information about prenups and how to make one.

Prenup is a Legal Contract

In the UK, prenups have become increasingly common, with approximately 20% of couples now entering into marriage with a prenup in place. This represents a significant rise from previous decades—only 1.5% of marriages involved prenups in the 1970s.

In the UK, a prenup is a legally binding contract entered into by a couple before their marriage or civil partnership. The prenup essentially sets out how they wish their assets to be divided if they divorce or have their civil partnership dissolved.

Purpose of Prenuptial Agreements: Prenups serve as a proactive measure for couples to establish financial and property arrangements before entering into marriage.

Their primary purpose is to provide clarity and prevent disputes in the event of a divorce or dissolution, offering a simple framework for the division of assets, spousal maintenance, and other financial matters.

Prenup Explained with a Video Game Example

Imagine you’re playing a video game where you’ve collected a bunch of coins and power-ups. Now, think of a prenup like a special code that keeps your coins safe, even if you decide to stop playing with a friend.

Without this code, if you and your friend decide to go separate ways, there’s a chance you might have to split your game coins with them—even the ones you haven’t found yet!

So, without a prenup, your savings and any future treasures you might get could be up for grabs, not just what you’ve already collected.

Read more: Marriage vs. Cohabiting

Are Prenups Legal?

Prenups are legally recognised but not automatically legally binding in England and Wales. This means that by entering into a pre-nuptial agreement, you cannot override the court's ability to decide how your finances should be divided on a divorce. However, the court must give appropriate weight to a prenup as a relevant circumstance of the case.

It is important to note that after the Supreme Court decision in the case of Radmacher v Granatino [2010], the court will now uphold a prenup that’s freely entered into by both parties (with a full appreciation of its consequences) unless it would be unfair to uphold it. Provided that test is met, the court will give effect to a prenup.

What this means is that both parties must enter into the prenup willingly, with a clear understanding of its implications. The courts will assess the fairness of the prenup based on several factors, including the parties' intentions, financial disclosure, and any changes in circumstances.

💡 The popularity and legal recognition of prenuptial agreements have been on the rise in the UK, especially after key legal cases in the early 21st century that reinforced their significance.

Lack of Prenup Complicates the Division of Assets

When couples tie the knot, the last thing on their minds is the possibility of their marriage coming to an end. The idea of planning for a divorce seems counterintuitive, if not downright pessimistic, during such a hopeful time.

However, a Prenuptial Agreement (Prenup) is not a bet against your marriage's success; rather, it's a practical measure for managing the unforeseen. The truth is, life is unpredictable, and a Prenup can serve as a safety net, ensuring that both parties are protected, regardless of what the future holds.

In the UK, where the division of assets can become a complex and contentious issue upon divorce, a Prenup provides a clear roadmap for what happens if the unthinkable occurs. It allows couples to decide how their assets, including savings, investments, and inheritances, will be divided.

This foresight can be especially crucial for safeguarding personal interests, such as inherited wealth or family heirlooms, ensuring they remain with the intended party rather than being subject to division.

Example: Successful Business, Inheritance and Divorce

Let’s consider Jane and Alex, a fictional couple who married without a prenup. During their marriage, Jane inherited a significant sum of money from a relative, which she used to contribute towards the couple's shared home and living expenses. Alex, on the other hand, built a small business that started to turn a profit in the later years of their marriage.

Unfortunately, Jane and Alex decide to divorce after several years. Without a prenup, the division of assets becomes complicated. Jane assumed her inheritance would remain hers alone, but since she commingled these funds with marital assets (like using them towards the shared home), that money is now considered in the division of assets. Similarly, Alex’s business, grown during the marriage, is also subject to division, despite it being his venture.

The lack of a prenup means that both parties enter into potentially lengthy and costly negotiations over who gets what, with the risk that a court’s decision might not align with what either party considers fair.

The process can strain their finances and emotional well-being, turning what started as an amicable separation into a contentious dispute.

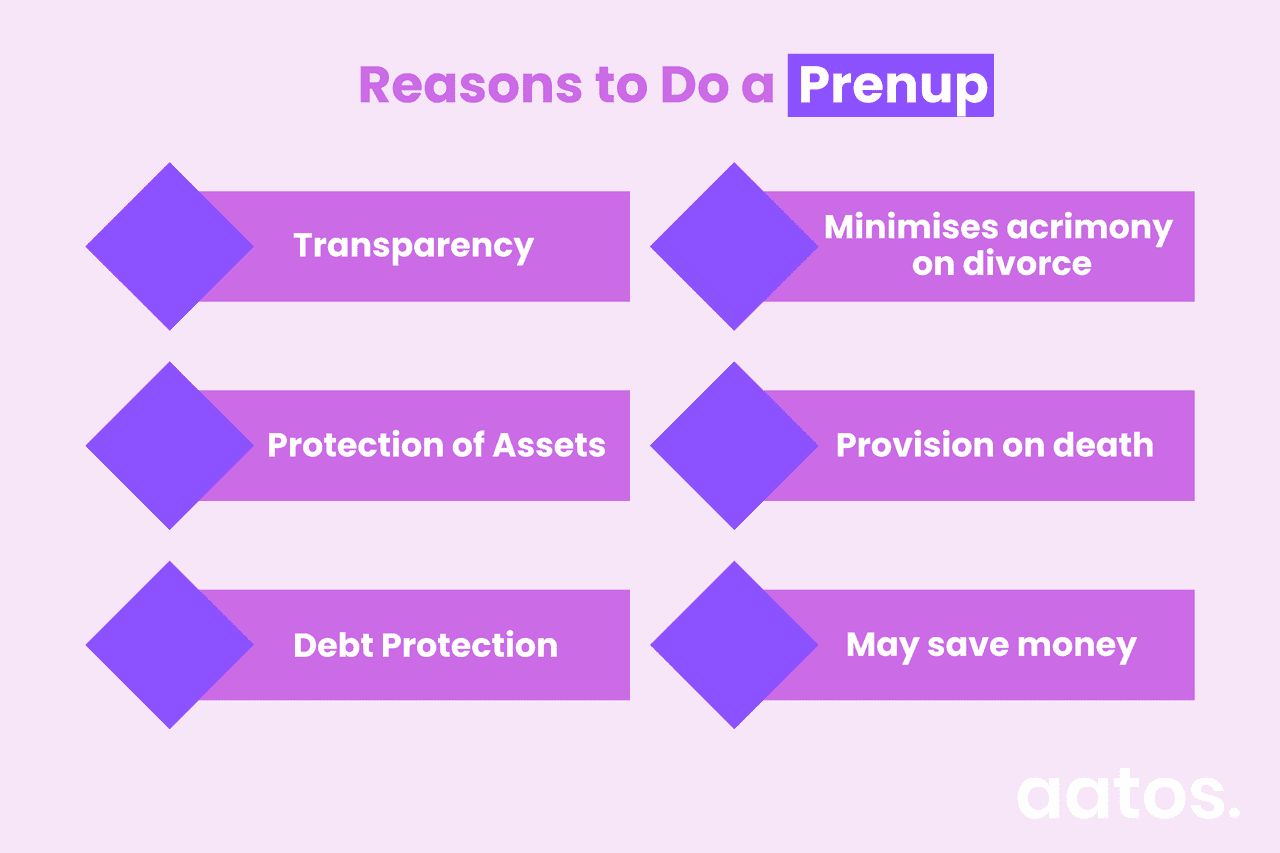

Advantages of Having a Prenup

There are numerous advantages of having a prenup, including the following:

- Clarity. You and your partner can make it clear to one another that certain property belongs to you alone and will not be shared during the marriage or on any future divorce.

- Certainty. You and your partner can agree at the outset of your marriage how your finances will be divided if you later separate or divorce. This should save you both the uncertainty, time and stress of litigating about your finances if you do later separate or divorce.

- Transparency. You and your partner should provide financial disclosure of your assets and income in the pre-nuptial agreement, so this means you will both know at the outset of the marriage the value of each other's assets, which will assist you in your negotiations.

- May save money. While you and your partner will incur legal fees for creating the prenup and obtaining independent legal advice, it’s usually much less expensive to negotiate and draft a prenup than to litigate about the division of your finances should you later separate or divorce.

- Protection of assets. You can protect assets, such as inherited assets, family heirlooms, an interest in a family business, or property acquired before the marriage. If the prenup agreement protects such property, the court is less likely to award a share of that property to the other party on any future divorce.

- Debt protection. If your partner has significant debts, either now or in the future, the prenup can be used to protect your assets from being used to satisfy those debts. (This will also be the case with any debts you may have now or in the future.)

- Compensation for loss of career. You and your partner can agree that if, during the marriage, either one of you give up a potentially lucrative career to care for the family, that person should be entitled to a greater share of the assets on the breakdown of the marriage to reflect their loss of earning power going forward. It is often difficult to convince the court to award an element of "compensation" for loss of career, but provision for compensation in the prenup is likely to be upheld by the court.

- Protection of family members. If you or your partner have children from a previous relationship, a prenup can protect their financial interestsby ensuring certain assets are kept for them in the prenup.

- Minimises acrimony on divorce. Setting out how assets are to be divided on divorce in the prenup should lead to fewer arguments about finances should you later divorce and result in a more amicable relationship between you.

- Improves communication. Discussing financial issues can be one of the most difficult aspects of marriage. Dealing with this at the outset of the marriage can strengthen a relationship and support good communication in the marriage.

- Protection of business partners. If you or your partner have an interest in a family or another private business, the prenup can protect that interest and prevent disruption to the business if the marriage breaks down in the future.

- Provision on death. The prenup can set out what should happen to your assets on your death. This can support the provision contained in your will and clarify what should happen to certain assets. For example, the inheritance prospects of children and grandchildren can be protected in the agreement.

- Freedom to agree your own terms. You and your partner may have a creative plan for dividing your assets if you divorce. A prenup provides you with the freedom to agree your own terms without the court imposing a solution on you.

- Marrying for money concerns. If you have concerns that part of the reason your partner wishes to marry you is due to your wealth. If they show commitment to negotiating a prenup that leaves you both with fair and reasonable financial provision, this may ease your mind.

Read more on How Common Is It to Write a Prenup in the UK?

Discussing a Prenup with Your Partner

Discussing a Prenup encourages open communication about finances, which is beneficial for any marriage. It prompts couples to have honest discussions about their assets, debts, and expectations for the future, laying a solid foundation for mutual understanding and respect.

Thus, while no one enters a marriage anticipating its end, a Prenup is a sensible precaution, ensuring that, should the path diverge, both parties are treated fairly and with dignity, making a potentially difficult situation a bit easier to navigate.

Checklist for Discussion about a Prenup

Discussing a Prenuptial Agreement with your partner can be sensitive, but it's crucial for ensuring both of you are on the same page regarding your future together. Here's a bullet list to guide you through this important conversation:

- Choose the Right Time: Find a calm, stress-free moment to bring up the topic. It shouldn’t be during times of conflict or significant stress.

- Express Your Feelings: Start by expressing your love and commitment. Make it clear that discussing a Prenup is not a sign of mistrust or doubt about your relationship’s future.

- Focus on Protection: Emphasise that a Prenup is about protecting both of you and ensuring fairness, not about anticipating a breakup.

- Discuss the Financial Transparency: Talk about how a Prenup can simplify financial matters and protect individual assets, including inheritances or personal savings.

- Reassure Commitment: Reinforce that your interest in a Prenup doesn’t stem from a lack of faith in your relationship but from a desire to take responsible steps for the future.

Remember, how you discuss a Prenup can set the tone for your communication and decision-making throughout your marriage. Approaching the conversation with care, respect, and openness is key.

How to Create a Prenup?

Creating a well-drafted prenup is crucial for its enforceability. The agreement should fully outline the financial arrangements, including the division of assets, treatment of premarital assets, spousal maintenance, and any other important considerations.

Key Considerations in Prenups:

- Full Financial Disclosure: Both parties must provide complete and accurate financial disclosure to facilitate a fair agreement.

- Independent Legal Advice: Each party should seek independent legal advice to understand the implications and fairness of the agreement.

- Fairness and Reasonableness: Courts are more likely to uphold agreements that are fair and reasonable to both parties.

- Changes in Circumstances: Prenups should account for potential changes in circumstances, such as the birth of children or significant shifts in financial status.

While a prenup is not a guarantee against legal challenges, a carefully drafted and fair agreement stands a better chance of being upheld in court. Courts may set aside an agreement if it is deemed unfair or if circumstances have changed significantly since its creation.

Get a Professional Prenup

It’s important to get a professionally drafted prenup. However, hiring a lawyer to draft one for you from scratch can be too expensive for the average consumer. As a result, many people turn to DIY prenup templates that you can find online.

Using a DIY prenup template may seem like a cost-effective and convenient option, but it comes with various risks that you should be aware of before proceeding.

Here are some potential risks associated with using a DIY prenup template:

- Lack of Personalisation: DIY templates are generic and may not address specific circumstances or preferences. Every couple has unique assets, financial situations, and concerns. Failing to customise the prenup according to your specific needs can lead to oversights and omissions.

- Incomplete or Inaccurate Information: Legal documents require precise and accurate information. DIY templates may not guide you through providing all the necessary details. Inaccuracies or incomplete information could jeopardise the validity of the prenup.

- Failure to Meet Legal Requirements: DIY templates are usually not tailored to meet UK requirements, rendering the prenup unenforceable.

- No Legal Guidance: DIY templates lack the expertise of a legal professional. Understanding legal jargon, implications, and potential pitfalls can be challenging for individuals without a legal background.

- Risk of Ambiguity: Ambiguous language or unclear terms in a prenup can lead to disputes in the future. Legal professionals are skilled at drafting clear documents, reducing the likelihood of misunderstandings.

- Limited Consideration of Future Changes: Life circumstances change, and a prenup should account for potential shifts in the future. DIY templates don’t generally address changes such as the birth of children, career developments, or variations in financial status.

- Potential for Legal Challenges: A poorly drafted prenup is more susceptible to legal challenges. If the document is unclear, unfair, or fails to meet legal requirements, it may not hold up in court if contested.

- Future Enforcement Issues: A prenup drafted without legal expertise may face difficulties in enforcement later. Courts may be more likely to uphold agreements that have been professionally drafted and meet all legal requirements.

While DIY prenup templates might seem like a quick solution, the risks associated with potential legal complications and misunderstandings underscore the importance of having a prenuptial agreement professionally drafted to ensure it meets legal standards and adequately addresses your specific needs.

💡 Did you know that it's also possible to do a prenup during marriage? It's then called a postnup.

Aatos Helps to Do Prenup Online

Aatos is about to launch its own Prenup product that has been professionally drafted by our in-house lawyers in line with legal developments in the UK, including the latest case law.

With our legal expertise and our easy to use platform, all you need to do is answer some simple questions and a tailored prenup is created and delivered straight to your door. It’s seriously that easy - so keep your eyes peeled for our official launch!

Prenup Brings a Peace of Mind

In conclusion, a prenup is a valuable tool for couples seeking to establish financial arrangements and protect their interests in the event of a divorce or dissolution. Seeking legal advice, ensuring transparency, and addressing key considerations during the drafting process are essential steps toward creating a robust and enforceable prenup in the UK.

Remember to keep your eyes peeled for our official Prenup launch, which is coming very soon!

Read More